- TURBOTAX DISCOUNT CODE 2019 BANK OF AMERICA SOFTWARE

- TURBOTAX DISCOUNT CODE 2019 BANK OF AMERICA PLUS

- TURBOTAX DISCOUNT CODE 2019 BANK OF AMERICA DOWNLOAD

TURBOTAX DISCOUNT CODE 2019 BANK OF AMERICA SOFTWARE

Now, let’s look at the advantages of buying TurboTax software at Costco.

TURBOTAX DISCOUNT CODE 2019 BANK OF AMERICA DOWNLOAD

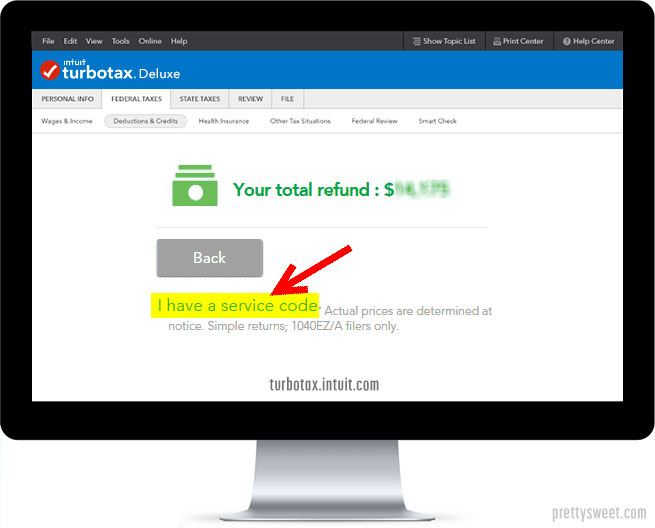

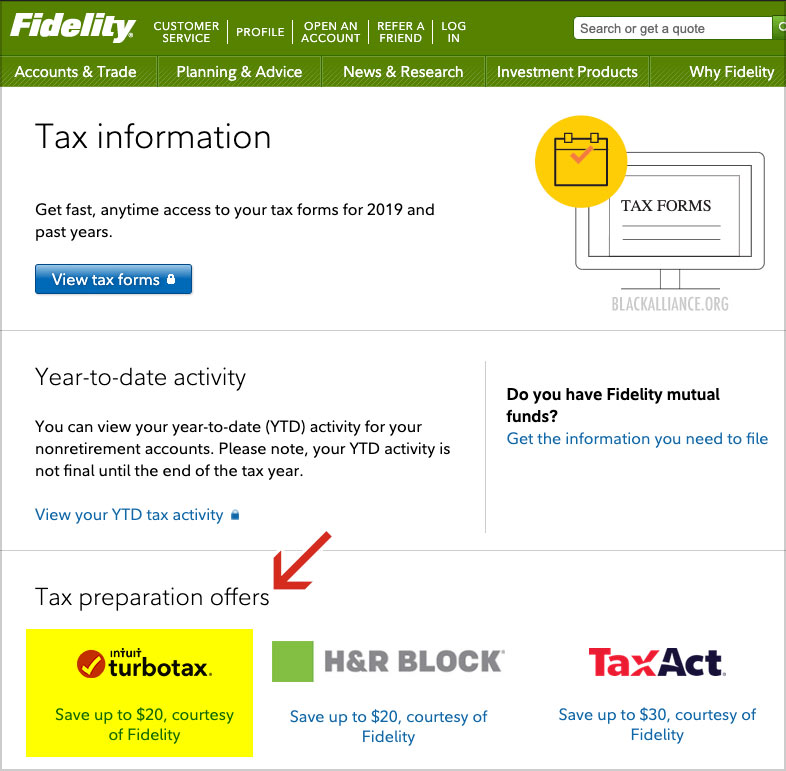

OK, those are the best reasons to download TurboTax online. You also might be eligible for a discount on TurboTax if you buy it through groups or financial institutions like AAA, AARP, Bank of America, or Chase bank. when you may be able to file State for free. Online Coupon? There’s always a coupon or discount available online, and the best deals are early in the tax season.“Free Edition” Option – If you have simple taxes (1040EZ) you can file with their free edition online.No need to worry about technical failure that might result in the loss of your progress or documents Peace of Mind: Online saves your work in the cloud.Specifically, by being online-based, you have the ability to access your tax return from various computers and devices, or even your phone Convenience: The main difference in my opinion is that TurboTax online offers more flexibility and convenience.OK, should you buy TurboTax at Costco, or use the online version? The best prices are early in the season, and as the April tax deadline approaches the prices go up! Note that the pricing for TurboTax Costco and online change during the tax season. Usually, Costco is the lowest price on just about everything, and their discount price on TurboTax usually rivals or beats the online price. However, if you file your taxes before March 15th, you may be able to avoid this state fee by filing online. * State efile costs an extra $50 for both TurboTax online and at Costco.

TURBOTAX DISCOUNT CODE 2019 BANK OF AMERICA PLUS

Wow, the prices are surprisingly similar! Factor in the time it takes to drive to the store plus the price of gas, and you really aren’t saving much buying TurboTax at Costco. Here is a price comparison of TurboTax Deluxe, Premier, and Home & Business editions at Costco and online. In this case, we compared the price of TurboTax at Costco with the discounted online price (after applying this coupon). This form is mailed out in late January for the prior tax year.In order to answer that question, let’s look at the differences between Costco and online download including features and prices:īefore getting into differences in features and functionality, let’s look at the cost. However, distributions from an IRA are reported to you and the IRS on a Form 1099-R. Interest postings to IRAs are not reportable.

Special note about Individual Retirement Accounts (IRAs)

To issue you a Form 1099-INT, TD Bank reviews all of your account relationships (interest-earning accounts like checking, savings, money market and CD accounts) and sends one Form 1099-INT to cover all of your accounts in which you are the primary owner.

If this applies to you, then you can expect to receive your tax information within the first two weeks of February. Typically, TD Bank mails 1099 tax forms to applicable customers in late January. If they are listed second on the account, they would be considered the secondary owner. You may co-own an account(s) with another person – spouse, partner, child, etc. If you are listed first on an account, you are considered the primary owner. Only the primary owner will receive a Form 1099-INT. For individuals, the Tax ID number is typically your Social Security number. Form 1099-INT is produced if the aggregated interest earned for a particular Tax ID number is $10 or more.

0 kommentar(er)

0 kommentar(er)